Last Updated: February 24, 2022

You have received a letter or notice from the IRS. Of the many questions going through your head, the most important one is likely, “what does my IRS notice number mean?” Whatever the case may be, if you received a letter or notice from the IRS it is most likely one of the following reasons:

- You have a balance due

- You are due a refund

- The IRS has a question about your tax return

- The IRS needs to verify your identity

- Changes have been made to your tax return

- The IRS needs to notify you of delays in processing your tax return

Since opening the letter you have probably been experiencing a good amount of anxiety, but try not to get yourself too worked up. Your letter contains very important information, so the best thing you can do is read the whole letter carefully and then reply to it as soon as possible.

Be careful, It is likely that your IRS letter or notice requires a response by a specific date.

Complying with this deadline is in your best interest. Especially if you would like to minimize any additional interest and penalty charges, or to retain your right to appeal if you do not agree with the information.

Guide to IRS Notice Numbers

Your IRS letter or notice number corresponds to the particular type of notice you were sent, so figuring out what your number means is easier than you may have thought.

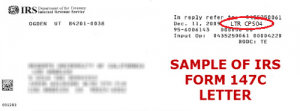

First, if you do not already know your letter or notice number, it can be found on either the top or bottom right-hand corner of the letter. “LTR CP504”” is the notice number on the sample letter below.

In the following section, we have provided a list of the most common letter numbers and a summary of what each means. However, if yours is not listed, there are two additional resources you can use to figure out what your IRS letter number means.

The people at the IRS have been nice enough to make a number reference table available to the public that explains each type of letter or notice by its number. We have included a reference table in our post The Complete Guide to IRS Notices that contains the information about each notice number and its meaning. Simply look up your number on the table to get the information.

How You Should Move Forward: The Next Steps

Now that you understand your IRS notice and the reason you have received it, the next step you should take is to respond to it. Typically, once the IRS sends you a notice you have a short window to respond. Whatever you do, do not ignore it. It is very important to stay in good standing with the IRS, and a failure to comply with the agency’s instructions is a one-way ticket to their bad side.

Your notice will list specific instructions to follow. Some notices are simply minor issues that need to be corrected, so it’s ok to respond yourself if you agree with the correction and feel confident that you know all the facts. If the notice is very complex, or you do not agree with the notice, it is highly recommended to seek advice from a tax professional.

FAQ

How do I deal with an IRS levy?

To prevent collection action you must reach an agreement with the IRS on what to do about your assessed debt. If you do not have an agreement, you may be open to enforced collections. If your account has been levied, you have 21 days to seek a release.

How do I check to see if I owe the IRS money?

If you are an individual taxpayer, the IRS’ website has an online tool you can register for to check your balance. You can also find out how much you owe by filling out and submitting IRS form 4506-T (request for a transcript of the tax return). You can also call the IRS directly at (800)-829-7650.

Can the IRS take my non-profit status?

The answer is yes. It is just as easy to lose your non-profit status as it was to gain it. The IRS takes away the tax-exempt status from over 100 organizations every year.

Most Common IRS Letters and Notices

| CP501/CP502

IRS notices CP501 and CP502 are the most common IRS notices sent out. They are sent to inform you of a past due tax obligation. |

| CP503

IRS notice CP503 informs you that you have 10 days to pay off your debt in full. Once this notice is sent you must either pay the entire amount of debt or work out a payment agreement. |

| CP504

IRS notice CP504 is the last alert you will receive about your tax debt. It is a warning that the agency has started preparations to seize your assets or tax refund. |

| CP523

In the event that you default on a payment agreement made with the IRS, you will soon after receive IRS notice CP523. This means that the agency intends to seize your income or assets. To avoid this, contact the IRS immediately, as it may be possible to restart your payment installments for a fee. |

| Letter 1058

IRS letter 1058 is a final notice that the IRS intends to levy. There are critical, time-sensitive appeal rights attached with this notice. We strongly recommend engaging representation if you receive this notice because bank accounts, accounts receivable levies and wage garnishments are eminent. |

| CP71C

IRS notice CP71C is sent to notify you about a tax debt that might have been overlooked for a number of years. You may receive this notice if you have not contacted the IRS to work out a payment arrangement, or have yet to make any payments. |

| CP90/CP297

This notice is sent to warn you of impending levies and seizures. It may inform you that payment in full is due within 30 days. |

| Letter 3174

IRS letter 3174 informs you that, after 10 days, the IRS is going to begin seizing your assets and property. |

| 668 A/W

Form 668-A or 668-W advises that either a bank account levy or wage garnishment has been issued. Please note that this notice will not be issued ahead of time. The levy will have already reached your bank or employer. You will not receive notice until after the action has already occurred. If you receive this notice, we urge you to call us immediately. |

| Letter 3172

This notice informs you a federal tax lien has been filed. This notice secures the federal government’s interest in your IRS tax debt. This is a public document. Other potential creditors and the public will not be aware that you owe money to the IRS. This will affect your credit and your ability to borrow and function as a business. It will also almost certainly result in several tax resolution companies calling your home or business. Make sure to choose your representation carefully and do your research. The following will link you to our Better Business Bureau reviews. so you can decide on your own. |

| Letter 668D

IRS letter 668D informs you that a prior levy has been released. |