On October 18, 2022, the IRS released its annual inflation adjustments for the 2023 tax year, which includes changes to more than 60 tax provisions, including tax rate schedules and the standard deduction.

The agency releases these adjustments annually to account for inflation and prevent what is called “bracket creep.” Bracket creep refers to inflation pushing taxpayers into a higher income bracket without an increase in their purchasing power.

This year’s above-average inflation brings with it bracket ceiling increases of about 7%, which should lead to smaller tax withholdings to anyone whose income has not kept pace with skyrocketing inflation. Though these new rates reflect the coming tax year, and therefore won’t affect filings until tax season 2024, it’s always a good idea to plan ahead — so don’t forget to reach out to your Boxelder accountant to initiate your next financial review.

2023 Tax Brackets & Tax Rates

The actual tax rates remain the same for the 2023 tax year- meaning the lowest bracket remains at 10% while the highest sits at 37%. However, the bracket parameters have increased pretty substantially. For example, if you’re a single filer making around $90,000 a year, you would be paying a 24% marginal tax rate for 2022, but only 22% for 2023. See the updated bracket parameters here:

2023 Standard Deduction

These adjustments also bring with them an increase in the standard deduction- the dollar amount by which your taxable income is reduced if you don’t prepare itemized deductions. The new standard deduction amounts are:

- $13,850 for single filers ($900 increase from 2022)

- $20,800 for head of household files ($1,400 increase from 2022)

- $27,700 for married couples filing jointly ($1,800 increase from 2022)

The additional standard deduction of $1400 to those over 65 or blind has been increased by $100 to $1500.

Bear in mind that you can only take the standard deduction if you don’t itemize your deductions. If you’re not sure whether to take the standard or itemized deduction, talk to your Boxelder accountant to discuss your tax liability!

Other Tax Adjustments for 2023

Alternative Minimum Tax Rate Changes

The alternative minimum tax (AMT) rate requires higher-income taxpayers to calculate their taxes under a second system, and pay the higher of the two. It was introduced in the 1960s to prevent the wealthy from using loopholes to avoid income taxes.

The IRS has increased the AMT exemption amount, which allows taxpayers to exempt a portion of their income from the AMT calculation. If your income is below the exemption amount, you do not have to worry about calculating your AMT tax rate.The new exemption amounts are:

- $81,300 for single filers ($5,400 increase from 2022)

- $126,500 for joint filers ($8,400 increase from 2022)

AMT exemptions phase out at 25 cents per dollar earned once AMT income reaches $578,150 for single filers and $1,156,300 for married taxpayers filing jointly, up from 539,900 and 1,079,800.

Earned Income Tax Credit (EITC) Changes

The Earned Income Tax Credit (EITC) is a way for low-to-moderate-income filers to reduce their amount of tax owed and potentially increase their refund amounts.

If you make less than the income amount at which the phase-out begins, you will receive the maximum credit, which differs by family size. The credit then decreases steadily until reaching the phaseout maximum. The 2023 tax adjustments have included a modest, but not unsubstantial increase in the EITC amounts, as well as the maximum income before phasing out of eligibility. See the EITC rates here:

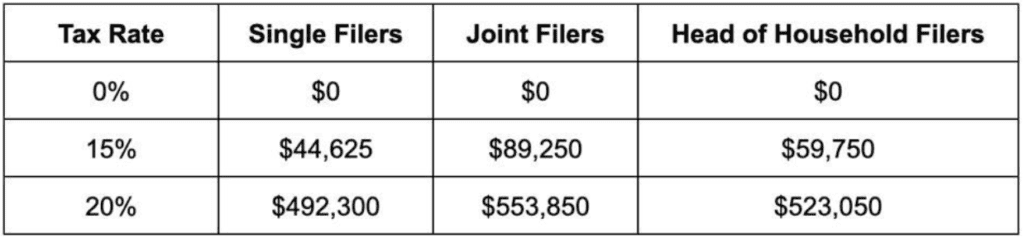

Capital Gains Tax Rates

The thresholds for capital gains income have been increased, though the rates have remained the same. The 2023 IRS adjustments for long-term capital gains are:

Specialty Allowances

Several specialty circumstances and exclusions have also been increased for 2023, so be sure to check if you qualify for any of the following:

- The annual exclusion for gifts will increase from $16,000 to $17,000

- The foreign earned income exclusion will increase from $112,000 to $120,000

- The maximum credit for adoptions will increase from $16,000 to $17,000

- Estate exemptions on inheritances will increase from $12,060,000 to $12,920,000

Get Ahead – Schedule A Financial Review With A Boxelder Accountant Today!

It’s always important to be prepared for potential changes that could affect your tax liability, and the best way to do that is to plan ahead. If you want to learn more about how these inflation tax adjustments could affect your tax liability and begin planning for next spring’s tax season, reach out to our award-winning team of expert accountants to schedule your financial review.