“Trust me,” your weird nephew said. “Bitcoin’s gonna be huge.”

It was 2010. You probably laughed off the suggestion. Back then, after all, it took 5,000 Bitcoins to buy a large pizza.

But maybe, just maybe, you listened and bought into crypto early. If so, good for you. Bitcoin has exploded in value since its inception — rising to over $47,000 per coin in 2021.

Whether you’re an early adopter or a recent convert, cryptocurrencies can still add value to your investment portfolio today. With more vendors accepting Bitcoin than ever before, virtual currencies have gained legitimacy in today’s market.

But with legitimacy comes regulation. And alas, taxation.

Too many cryptocurrency owners have a limited understanding of their tax liability. That’s a natural mistake. When Bitcoin launched, it was billed as an anonymous, untraceable currency, an income stream you could keep hidden from the taxman. But the IRS has caught up to crypto. And in 2021, it plans to increase the volume and scrutiny of cryptocurrency audits.

If you filed your tax returns without accounting for cryptocurrency transactions, it’s only a matter of time before the IRS discovers the mistake. But don’t worry. Boxelder Consulting can help you fix the problem before the IRS finds it. Here’s what you need to know:

For Tax Purposes, Cryptocurrency is Property

As we’ve covered in prior articles, the IRS treats all cryptocurrencies (such as Bitcoin) as property. Specifically, they’re classified as “intangible property,” the same category as stocks and bonds.

Like other forms of intangible property, cryptocurrency can be taxed as:

- Income – If cryptocurrency is received as payment for goods or services, then its Fair Market Value (FMV) on the date of receipt will be included in your income tax calculations. And if you obtain cryptocurrency through mining, the FMV on the date you mined it will be included in your gross income (for the self-employment tax).

Or

- Capital Gains – Though there’s no initial tax when you buy cryptocurrency, you’ll have to record a capital gain if you sell it for a higher price than its FMV on the date of obtainment. The same is true for taxpayers who obtained cryptocurrency as payment, or through mining. If it appreciates in value over time, you’ll have to pay taxes for the capital gain.

Remember: cryptocurrencies like Bitcoin are still extremely volatile. Though your investment in Bitcoin could result in a capital gain, it could also end up as a business loss if its FMV drops. Either way, your cryptocurrency holdings have a meaningful impact on your tax liability. At Boxelder, we can help you accurately determine what you owe to the IRS.

The IRS is Catching Up to Cryptocurrency Owners

For years now, enforcing cryptocurrency taxation has been a thorny issue for the IRS. Thanks to blockchain encryption, it’s historically been difficult to track down the source of a cryptocurrency transaction, and the identities of those involved. The IRS had little ability to enforce its own policies, letting millions of transactions go untaxed.

But things began to change in 2017, when the IRS sued Coinbase (a large cryptocurrency exchange) for the identities of its users. At the time, Coinbase had over 6 million registered users, but the IRS had recorded less than 1,000 taxpayers reporting cryptocurrency transactions. The IRS won the case, and Coinbase turned over at least 13,000 names.

Today, the IRS is even savvier at tracking down crypto users without the help of court orders. If this has you worried, don’t panic. The IRS knows that most taxpayers have good intentions, and it will give you a chance to make things right. At Boxelder, we can amend both your prior and current year tax returns for cryptocurrency before the IRS comes with an audit.

Best Practices for Tax Compliance

Thankfully, compliance is easier than you think. As with any type of taxes, it starts with maintaining detailed records. For all of your cryptocurrency holdings, make sure to record:

- The date when the cryptocurrency was received,

- The FMV on the date of receipt, and

- The purpose of holding the currency.

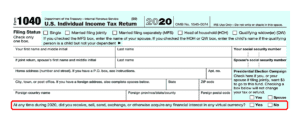

This will go a long way toward helping you understand your tax liability and prepare for payment. On the 2020 Form 1040, the IRS even added a new section on virtual currencies, making the process easier than ever.

But remember, if you wait any longer to reconcile your cryptocurrency holdings, it’s only a matter of time before the IRS sends you a warning letter. And If you’ve already received a letter, don’t delay any further. Give Boxelder a call at 888-573-5775, for a free consultation with licensed tax professionals. We can help you through this; it’s what we do.