What Happens If You Owe Back Taxes?

Taxes are already complicated and stressful, but if you fall behind on filing, things can get messy very quickly.

As penalties and interest pile up, taxpayers often find it more and more difficult to address the “black cloud” of back taxes hanging over them. The longer they wait, the more complicated it becomes to calculate how much they owe, and the more stressful it becomes to even think about facing their debt.

We see this every day at Boxelder. Ashamed of missing filing deadlines and letting their debt grow, many people with back taxes will wait years before seeking help. However, once they come in for their initial consultation, our clients often say they’ve felt a weight lifted from their shoulders.

Even the most responsible individuals and business owners make mistakes, and there’s no reason to feel bad about missing a filing or payment deadline. It literally happens to millions of Americans every year, and the IRS offers plenty of helpful programs for resolving your tax debt.

In other words: if you owe back taxes to the IRS, you are not alone — and you do have options. But the worst thing you can do is leave your debt unaddressed.

If you think you owe back taxes, don’t let the situation worsen. Take the first step toward financial freedom by scheduling a free consultation with our licensed tax attorneys.

In this guide, we’ll go over what happens when you don’t file your taxes, what sorts of collection actions the IRS might pursue, and what options you have to pay off your back taxes debt.

What happens if you don’t file your taxes?

If you don’t file your taxes by the deadline, you will face penalties and interest that will add to the amount that you owe. The IRS issues separate penalties for filing late versus paying late — this is why it’s important to file your taxes on time every year (or apply for an extension), even if you cannot afford to pay the tax you owe.

Back-Taxes: Penalty Fees for Individuals

Failure-to-file penalty: If you don’t file, you’ll face a failure-to-file penalty fee, which is 5% of your unpaid taxes for each month your tax return is late, up to 25%. In addition, payments made more than 60 days late will also incur a minimum fee of $135 or 100% of the taxes you owe (whichever is less).

Failure-to-pay penalty: If you file your taxes, but do not pay them on time, you’ll be charged a failure-to-pay penalty fee. This is 0.5% of your unpaid taxes for each month you don’t pay, up to 25% of the back taxes owed. Plus, you will be charged interest on the unpaid amount.

These penalties and interest apply for each month or partial month after the payment due date, and they start accruing the day after the tax-filing due date.

Back-Taxes: Penalty Fees for Small Business Owners

As a small business owner, you withhold payroll taxes from employee wages. This means that you must:

- Report and pay federal and state taxes to the appropriate tax agencies

- Accurately report income, amounts withheld, and amounts paid on behalf of employees and contractors

- Maintain required federal and state records

Payroll taxes are paid on either a biweekly or monthly basis. Employers are required to report their payroll tax payments on a quarterly basis by filing Form 941. This form requires an employer to add up the total payroll tax contributions within the given quarter.

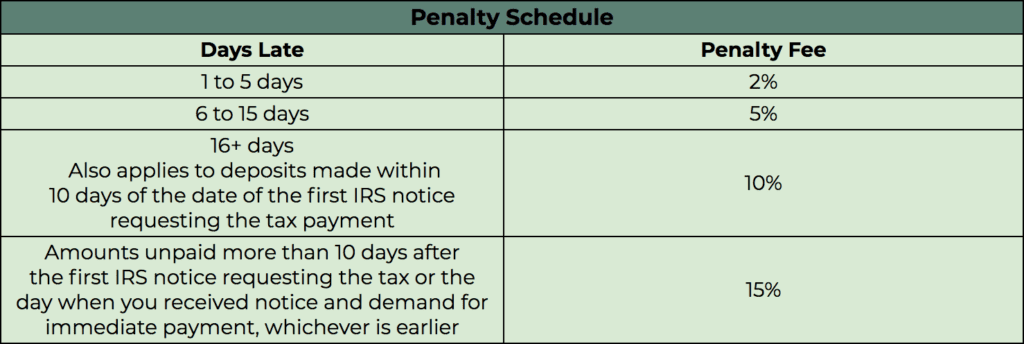

However, if you don’t make payroll tax deposits accurately and on time, you will face additional penalties. And because the vast majority (about 70%) of the annual tax revenue collected by the IRS comes from payroll taxes, the IRS is quick to send notices in these situations.

In addition to the penalty fees shown in the table, not paying payroll back taxes could also result in criminal fines and even imprisonment.

When it comes to payroll taxes, failure-to-pay penalty fees increase quickly — every day that ticks by, you’re losing money. Therefore, especially in these situations, it’s imperative that you take action in a timely fashion.

How to file back taxes

The easiest way to resolve back taxes is to file your late tax returns. To avoid increased penalties and further consequences, follow these steps for filing your back taxes.

Note: If you are due a refund, remember that the clock is ticking. You only have three years from the original tax deadline to submit your return and claim your back taxes money.

- Gather Your Documents: Locate your W-2 and 1099 forms for the tax years you’re filing for, as well as any other information regarding income earned for that period. You can also request your wage and income transcript from the IRS.

- Prepare Your Returns: Any tax returns from previous years must be filed using the specific tax rules and instructions for those years. If you use incorrect forms or guidelines, it can cause even more problems for you.

- Plan For Payment: If you owe taxes on your unfiled returns and can’t pay, you’ll need to utilize an alternative tax relief solution (see section III) to resolve your IRS debt. For instance, you may need to request an installment agreement, which allows you to pay your tax debt over monthly payments instead of one lump sum.

- Request Penalty Abatement: If you only have one past-due tax return, you may be eligible for first-time penalty relief. This can help erase, or reduce, the penalties assessed to your overdue return.

- Submit Your Returns: Late tax returns can only be filed on paper and must be delivered to your local IRS Service Center either in person or by postal mail. Be sure to use certified mail, so you have proof that the IRS received your returns. Each return should be sent in a separate envelope to avoid potential confusion or clerical errors.

Dealing with unfiled tax returns and back taxes can be daunting — especially when it comes to Steps 1 and 2. Tax regulations vary by year, and if you file past-year returns incorrectly, you’ll only make matters worse.

That’s where we come in. At Boxelder, our back tax experts have decades of experience in filing prior year returns and helping taxpayers get back on their feet. Reach out to our team today to start your comeback story.

IRS Collection Enforcement Actions: What Happens If You Don’t Resolve Your Back Taxes?

We’ve just gone over the penalties and interest that can accrue on unfiled and unpaid taxes. But unfortunately, that’s only the tip of the iceberg. The longer you wait to resolve your back taxes, the more likely it is that the IRS will aggressively pursue collection on the tax you owe.

Keep in mind that the IRS may move deceptively slow. Don’t be lulled into a false sense of confidence; it can take up to four years for the IRS to spot a problem and send you a notification.

However, once the IRS does catch up, they tend to move quickly. Your first notice will likely be a IRS Notice CP14, which triggers the beginning of the IRS Collections process.

Ignoring the CP14, or taking too long to respond, is a bad idea. If you feel that the IRS made a mistake, and if you can prove (or wish to prove) that you do not owe additional taxes, speak with a tax attorney as soon as possible. You do have the option of appealing your debt with the IRS in an independent appeals process, and if that fails, you can still take the IRS on in U.S. tax court.

If you don’t respond, the IRS will continue to send notices and, eventually, they will take action and access your funds through other means. Here are some of the more serious consequences of unaddressed back taxes:

Tax Liens

What is a Tax Lien?

A tax lien is a legal claim against the assets of an individual or business who fails to pay taxes owed to the government. In general, a lien serves to guarantee payment of a debt such as a loan or, in this case, taxes.

In addition to hurting your credit and reputation, liens can lead to even worse consequences. If the obligation is not satisfied, the creditor may proceed to seize the assets.

Tax Lien Notifications

The tax lien process begins when the IRS files a public document, the Notice of Federal Tax Lien, to alert creditors, banks, and other financial institutions that the government has a legal right to your property.

Tax Levies

What is a Tax Levy?

An IRS levy is the legal seizure of property to satisfy an IRS tax debt.

Tax Levy Notifications

CP504 – Notice of Intent to Levy

If you have not responded to previous demands for payment, the IRS will then send a Notice of Intent to Levy, also known as a CP504. This notice is required by Internal Revenue Code Section 6331. This serves as your final reminder that the IRS intends to levy your wages, bank accounts, and tax refunds to satisfy your unpaid back tax debt.

1058 (LT11) – Final Notice of Intent to Levy and Notice of Your Right to a Hearing

The IRS uses both LT11 and Letter 1058 to advise taxpayers that it intends to levy their property and that they have a right to file an appeal. LT11 is a shorter notice but the message (and the warning) is essentially the same. If you don’t respond within 30 days from the date of the letter, the IRS can levy your assets, such as salary and other income, bank accounts, personal and business property, state tax refunds, and even Social Security benefits.

Form 12153 – Request for a Collection Due Process (CDP) or Equivalent Hearing

If you disagree with the assessed amount, you can file a Form 12153 — Request for a Collection Due Process or Equivalent Hearing. Information on how to exercise this option can be found in Letter 1058. At this stage in the process, we highly recommend hiring representation and tagging in a tax lawyer who can negotiate directly with the IRS on your behalf.

Wage Garnishment

What is Wage Garnishment?

Wage garnishment is a type of collection process whereby the IRS will seize funds directly from your paycheck to satisfy back tax debt.

Wage Garnishment Notifications

CP14, CP501, or CP503 – Notice and Demand For Payment

The IRS will first send a notice of tax balance due and request for payment. It includes the amount you owe, payment options, and the deadline for repayment. You have 21 days to pay the tax bill in full or you will face additional interest and penalty fees.

CP504 — Notice of Intent to Levy

If you have not responded to previous demands for payment, the IRS will then send a Notice of Intent to Levy, also known as a CP504. This notice is required by Internal Revenue Code Section 6331. This serves as your final reminder that the IRS intends to levy your wages, bank account, and tax refunds to satisfy your unpaid tax debt.

LT11/Letter 1058 – Notice of Your Right to a CDP Hearing

If you’ve received a Notice of Your Right to a CDP Hearing via certified mail, this is the final step of the wage garnishment process before the IRS can start seizing your paycheck. The CDP notice explains your right to request a hearing within 30 days of the date on the notice. If you plan to challenge the wage levy, you must do so before the deadline date.

Form 668-W – Notice of Levy on Wages, Salary, & Other Income

The IRS will send your employer Form 668W if you have not requested a hearing within the designated timeline on your CDP notice. This notifies them that the IRS intends to levy your wages. Your employer will then ask you to sign the Statement of Exemptions and Filing Status. If you do not complete and return this within 3 days, the exempt amount will be calculated as though you are married and filing separately with no children. It generally takes only one pay period before the IRS begins to levy your paycheck, or approximately 15 days after the CDP deadline has passed.

Tax Relief Solutions: What To Do If You Can’t Pay Back Taxes?

Okay, so you’ve sent in all of your unfiled tax returns, and now you finally have a confirmed balance of what you owe the IRS. But what if you can’t afford your tax bill?

Luckily, the IRS offers several helpful programs for taxpayers looking to satisfy their back-tax debt. Here are some of the most common options for people who owe back taxes but cannot pay:

Short-Term Extension

If you can pay the full amount of your IRS debt in 120 days or less, you may qualify for a short-term extension. You can apply for these on the IRS website, and there is no set-up fee.

Installment Agreement

If you cannot pay your back tax debt in full within 120 days, the IRS also offers long-term payment plans known as Installment Agreements. Payments are extended over 4 months or more, and set-up fees range from $31 to $225, depending on how you apply.

There are several different types of IRS installment agreements, some of which require verification of your financial status. To learn more about the types of installment agreements and how to apply for them, visit our Installment Agreement page.

Offer-In-Compromise

An offer in compromise is an IRS program that allows you to make an offer of less than the total amount owed toward your back tax debt. If the agency accepts the offer, you will pay your settlement amount, and the rest of your IRS debt will be wiped clean. However, the IRS will only accept your offer if they feel that it is greater than or equal to the amount they would ever collect from you.

There are two major points to understand about the OIC process. Firstly, most offers get rejected (about 60 percent) — the odds are not in your favor.

Secondly, outside of an audit, an OIC is the most scrutinizing process a taxpayer can experience. Because of the significant savings associated with tax settlements, the IRS specialist assigned to your case will investigate past and current financial transactions, along with any property and assets.

In short, every aspect of your financial life will be probed and prodded until no stone is left unturned. The whole thing can be intrusive, unsettling, and extremely stressful, so you should consult with a licensed tax professional before considering this route.

Currently-Not-Collectible Status

If you can prove to the IRS that you are currently facing financial hardship, they may agree to grant you Currently Not Collectible (CNC) status. This is a two-year relief period during which the IRS cannot pursue collections and you are not required to make payments toward your back taxes debt.

Your Free Back Taxes Consultation

Take Your First Step Toward Tax Debt Freedom

As we covered at the start, one of the hardest parts of tackling back taxes is simply getting started. At Boxelder, we’ve tried to make that first step a little bit easier through our free back taxes consultation. Once you schedule your initial appointment, you’ll be on your way to tax debt freedom.

Here’s what to expect from our licensed tax professionals at your 30-minute tax relief consultation:

1. Review Your Case

To get a better understanding of your particular back taxes situation, a Boxelder tax attorney will ask you about the amount of debt you owe, which years are left unfiled, and any extenuating circumstances that hampered your ability to file or pay on time. Although some of these questions may be uncomfortable to answer, it’s important that we get a clear understanding of what caused your tax debt so we can give you an honest assessment and find the best possible solution.

2. Explore Potential Tax Relief Options

Once we have gathered all relevant information pertaining to your back taxes, we will review your potential tax relief services. This includes providing a step-by-step plan and timeline for resolving your tax debt, as well as discussing the fees associated with these services. We will answer any questions you have about the process. Remember, you are not obligated to purchase any of the services suggested and may choose to decline our help.

3. Get To Work

If you decide to move forward with our tax resolution services, we will ask you to sign a service agreement, as well as IRS Form 8821, Tax Information Authorization. This form allows Boxelder to contact the IRS on your behalf, review your tax file, and determine whether a revenue officer has been assigned to your case. Once all information is verified, we’ll get to work resolving your back taxes as quickly as possible!

Back Taxes FAQ

How many years can I file back taxes?

Six years. The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing.

How many years can I file back taxes and get a refund?

Three years. A return claiming a refund must be filed within three years of its due date for the IRS to issue a refund.

How long can the IRS collect back taxes?

10 years. The IRS statute of limitations is the time period after which the IRS can no longer collect on back tax debt. It is typically a time limit of 10 years from the time of penalty. The due date is known as the Collection Statute Expiration Date (CSED).

How much do I owe in back taxes?

You can access your federal tax account through a secure login at the IRS website. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.