Tax Season 2024 – Important Dates & Deadlines

The 2024 tax season is upon us, and our Wichita and Denver CPA’s and tax accountants are ready and rearing to help you and your business navigate it. For many people, tax season is the most stressful time of the year. We get it. However, as Denver’s premiere tax services firm, we also know that […]

PSA: Boxelder Consulting Is a Proud Ally — And We’re Not Going Anywhere

At Boxelder Consulting, our work goes far beyond tax relief and accounting. We help businesses stay compliant. We guide individuals through the stress of IRS issues. But more than anything, we believe in showing up for people with respect, care, and integrity. Now that the fall tax season has passed, we want to take a […]

Navigating IRS Shutdowns: What You Need to Know

As a tax consulting firm committed to providing valuable insights into the ever-evolving world of taxation, we believe in keeping you informed about the latest developments that could impact your financial well-being. Let’s discuss the recent revelation regarding the Internal Revenue Service (IRS) and its preparations for a government shutdown. IRS Faces Unexpected Challenges The […]

IRS Launches Aggressive Pursuit of Wealthy Tax Dodgers: What It Means for You

In a recent announcement, the Internal Revenue Service (IRS) has declared its intent to target 1,600 millionaires and 75 large business partnerships with substantial tax liabilities. These individuals and entities collectively owe hundreds of millions of dollars in back taxes. This bold move comes as part of the IRS’s renewed efforts, fueled by increased federal […]

News: IRS to End Surprise Visits to Homes and Businesses

The Internal Revenue Service announced recently that it will immediately scale back its practice of sending unarmed agents to make surprise visits to homes and businesses. The visits were a core part of the agency’s efforts to collect unpaid taxes for the last few decades. The change came about, in part, due to the prevalence […]

Boxelder Named One Of Denver’s Best Tax Services For 2023

Boxelder Consulting is honored to announce that our firm has been named to Expertise.com’s list of the Best Tax Services in Denver for 2023. Our team was selected from a competitive pool of more than 150 Denver tax firms, earning recognition for our qualifications, level of experience, availability, professionalism, and reputation. This is Boxelder’s second […]

Filing for FAFSA: How Your Tax Return Affects Your Child’s Education Funding

Whether your high schooler is dreaming of ivy-covered dorm rooms or the state college up the road, chances are you’re thinking of how you’re going to pay for it. Between tuition, room and board, books, and living expenses, the bill keeps getting higher and higher. That’s where the Free Application for Federal Student Aid (FAFSA) […]

Tax Season 2022 – Important Dates & Deadlines

It’s that time of year again — and no, we’re not talking about March Madness. Tax season is here. And with the IRS continuing to grow overwhelmed by its pandemic-induced backlog, it’s shaping up to be another hectic one. This means, yet again, that during the busiest and most complex months for most taxpayers, you can […]

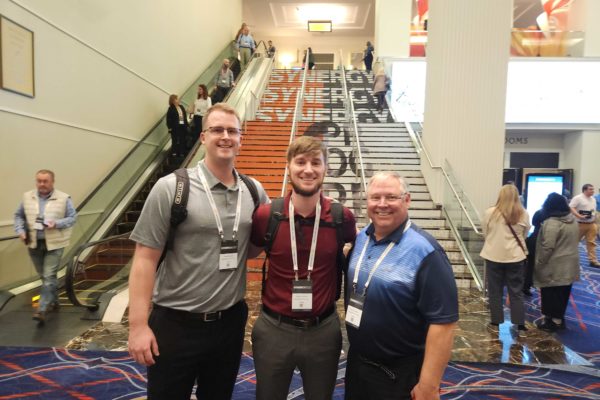

Boxelder Attends Synergy 2022 Thomson Reuters Conference

Boxelder Consulting Attends Synergy 2023 – Thomson Reuters Annual Conference For Tax And Accounting Firms Earlier this month, our nation’s capital got a much-needed boost of ethics and responsibility, as members of Boxelder Consulting’s award-winning tax team came into town for Synergy 2022. Hosted Annually by Thomson Reuters, the Synergy User Conference For Tax And […]